Home Loans 'useful debt instrument' says FNB

Speaking to SA Commercial Prop News on a media brief held on Monday, Head of Sales at FNB Home Loans, Ewald Kellerman says home loan is still the cheapest finance and most flexible debt class.

Speaking to SA Commercial Prop News on a media brief held on Monday, Head of Sales at FNB Home Loans, Ewald Kellerman says home loan is still the cheapest finance and most flexible debt class.

A Home Loan does not just enable a person to buy a property, but can be a very useful debt instrument or even interest savings mechanism that stretches far beyond an initial property transaction, according to FNB's latest Home Loans Quarterly Report.

The report suggests a home loan, if managed properly, is “still arguably the cheapest, most flexible way of borrowing money”.

“The current financially pressured household sector environment necessitates that consumers start understanding how to optimise their debt structures to work towards financial wellbeing. The home loan can be a key debt instrument in assisting with such debt management improvements‚” Ewald Kellerman head of sales‚ FNB Home Loans said on Monday.

The past decade has seen one of the largest historic shifts in consumer debt levels. Consumer debt levels remain high and the decline over the past three years in the ratio of disposable income to debt has slowed. Not only did the household sector debt-to-disposable income ratio rise to an all-time level by 2008, but the ways in which households borrowed changed significantly too.

More and more, credit is being used not only to finance assets such as homes and vehicles, but also lifestyle. Such practices can be risky, and while much time is spent on consumer education and understanding of investment markets and returns, the largest part of the household sector could arguably benefit more from a better understanding of credit instruments rather than investment products. The discussion may sound similar, but managing debt is often far more relevant to a low savings, highly-indebted household sector.

The Household Sector debt to disposable income ratio gradually declined from the all time high of 82.7% in 2008 to 75% by the end of 2011. This was a positive trend, as the level of household indebtedness was widely seen as being on the high side. However, this ratio began to rise mildly in 2012, and by the end of the year was slightly higher at 75.8%. This implies that there is still much work to be done in terms of lowering the debt levels that funded the property and consumer boom in the earlier part of last decade.

Prolonged low interest rates have offered an opportunity to reduce this level of household debt. However, consumers tend to be “pro-cyclical” in their spending/borrowing, and generally borrow more when interest rates are low instead of using the low rates to reduce debt. Hence the 2012 resumption of a rising debt-to-disposable income ratio.

Residential mortgages still make up the largest part of the household sector’s debt burden, i.e. 58% of total credit extended by banks to the household sector. The value of residential mortgage loans to the household sector grew at a year-on-year rate of 2.3% in December 2012. However, mortgages have lost a great deal of the share of household credit classes to the instalment sale and unsecured market, with overall non-mortgage credit to the household sector growing by a massive 23.3% year-on-year as at December 2012.

However, despite the relative decline in popularity, a Home Loan is still arguably the cheapest, most flexible way of borrowing money. A Home Loan does not just enable a person to buy a property, but can be a very useful debt instrument or even interest savings mechanism that stretches far beyond an initial property transaction.

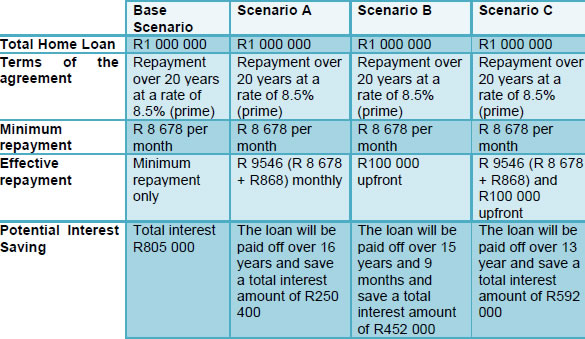

Consumers do not always realise the power that a Home Loan holds and may often be discouraged by the relative long term of the repayment period. At the start of a 20 year credit agreement, it may seem that there is little incentive to accelerate the minimum repayment, because one initially sees so little visible benefit in terms of a reduction in the capital amount outstanding. However, changes in the repayment value in the early stages of repayment of the loan could significantly affect the total cost of the transaction. Small changes in the way a Home Loan is managed can make a significant difference down the line.

Meanwhile, the FNB house price index showed a 2.6% year on year (y/y) increase for February after a revised 3.9% y/y gain in January.