Direct property outperforms other assets

The South African investment property sector delivered an ungeared total return of 13.5% in 2015 – an increase of 50 basis points from 13.0% in 2014

The South African investment property sector delivered an ungeared total return of 13.5% in 2015 – an increase of 50 basis points from 13.0% in 2014

Despite South Africa's economic and social headwinds, 2015 proved a good year for direct commercial property and for those attuned to its peculiarities.

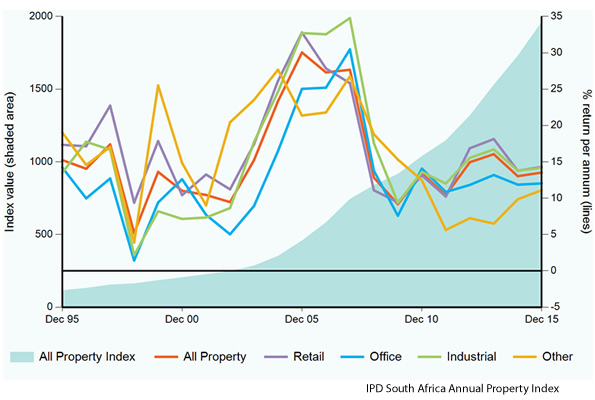

The South African investment property sector delivered an ungeared total return of 13.5% in 2015 – an increase of 50 basis points from 13.0% in 2014, according to IPD South Africa Annual Property Index released recently by MSCI Inc.

Income return remained steady at 8.7%, while capital growth ticked up to 4.4% - up 40 basis points from the year before. Capital growth was driven by a 5.2% growth in base rental while yield compression also contributed 1.0%. However, a negative income residual, an indication of sentiment, of -1.8% reflected a cautious attitude among valuers and detracted from overall capital growth.

The latest property index, sponsored by Nedbank CIB over the period, reflecting the value of this asset class in volatile times. Over a five-year period, direct property maintains its reputation as a hybrid asset class, delivering a total return between the MSCI SA Equities Index and bonds at a lower volatility.”

He adds, “The headline figures show that the property sector is treading water. Although prospects for absorbing excess market supply in a low-growth environment remain; economic and political shocks present serious downside risk to confidence and investment appetite.”

Aggressive asset and property management remains a key theme in the year’s results where tenant retention was a priority. Although basic rental growth was similar to the year before, operating costs declined as a percentage of gross rentals.

At a sector level, retail property was the top performing sector during the year with a total return of 14.3%, marginally outperforming industrial at 14.2%. The office sector continued to underperform in a difficult market, though it still managed a respectable 12.0% total return, mainly because of significant income return, which stood at 9.8%. The vacancy rate of all three major sectors trended broadly sideways during the year, but excess supply in specific property segments and geographies continue to weigh on base rental growth.

At a property segment level, CBD and decentralised offices counted among the worst performing segments for the year. Super Regional shopping centres, with a total return of 13.6%, counted among the most improved segments for the year after a slight value correction in 2014. A positive yield impact and minimal income residual suggests this segment is now fairly priced, which is critical as the economy enters a period where disposable income may come under pressure.

Robin Lockhart-Ross, Managing Executive of Nedbank Nedbank Corporate and Investment Banking said, “Once again the index results for 2015 have demonstrated the resilience of the South African investment property sector in the face of a challenging economic and socio-political environment, characterised by low GDP growth and increasing cost pressures. This is a consequence of the quality of the property portfolios and the professionalism of asset management in the sector, which make commercial property an attractive asset class for investors looking for sustainable growth and consistent returns over time. The results endorse our confidence in and experience of the sector from NCIB’s perspective as the leading provider of commercial mortgage finance to the SA property industry.”