Office sector drifting

The office sector remains in recovery mode with a sustained improvement in the office vacancy rate relying on a strengthening of macroeconomic drivers such as economic growth, Sapoa said

The office sector remains in recovery mode with a sustained improvement in the office vacancy rate relying on a strengthening of macroeconomic drivers such as economic growth, Sapoa said

Office vacancies remain flat in South Africa suggesting that not enough new supply is coming on board, the South African Property Owner’s Association (Sapoa)’s latest vacancy report shows.

Only larger offices for big blue chips are coming online, SA Commercial Prop News has learned.

The situation also suggests that not many new companies are growing in SA or entering SA and looking for new offices. The economy needs to gain momentum in order to help a struggling office sector.

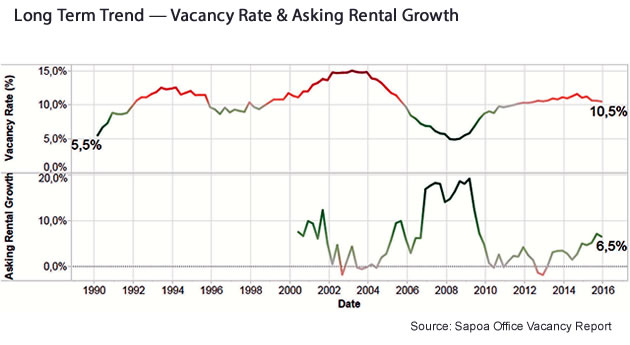

At the end of December last year, the national vacancy level was recorded at 10.5%. This was flat compared with the quarter before which saw a reading of 10.6%.

“The sideways trend of the last five years remains firmly in tact – ever since vacancies increased to 9.8% post the recession of 2009,” Sapoa said.

Asking rentals are beating inflation, with year on year growth of 6.5% last year, which is down from 7.1% in the third quarter. Sapoa says this is because of office oversupply.

“The office sector remains in recovery mode with a sustained improvement in the office vacancy rate relying on a strengthening of macroeconomic drivers such as economic growth, business confidence and financial and business services capital investment,” said Sapoa.

The latest quarter saw an improvement in all office grades with the exception of A-grade offices which saw vacancy rates weaken by 40 basis points.

The prime office segment saw the greatest improvement over the past quarter with vacancy rates improving by 2.1% over the previous quarter to end at 5.3%. The prime office vacancy rate is still high in historical terms having increased from below 2% since the end of 2013.

Thus offices in SA are in a fragile state and the country needs new entrants’ inti the economy, many of which may be need to be large multinationals in order to make any dent into the prevailing vacancies.

Economic growth and business confidence do not bode well for the sector. Investment bank Stanlib’s chief economist, Kevin Lings, has said he expects SA’s economy to grow 0.9 percent this year.

The latest business confidence number saw a slip to 36, suggesting an overall negative sentiment among business executives, which is likely to see industry decision makers maintaining an increasingly selective approach to capital allocation.

Izak Petersen, CEO of Dipula Income Fund, says that the office market is struggling and his company has shifted to be 70% retail.

“Right now retail assets are the strongest and many property funds are in them for their defensive nature,” he says.

In terms of municipal offices, Cape Town has the lowest vacancy rate with 7.2%, this is an encouraging improvement of 1.8% over the last quarter of last year. Nelson Mandela Bay metro enjoyed the largest improvement with office vacancy rates down 3.7% to end at 14.7%, driven by an improvement in the Central Park drive node. The City of Tshwane followed Cape Town with an overall vacancy rate of 8.8% while Johannesburg recorded an office vacancy rate of 11.8%.

Inner city vacancy rates are very high across South Africa’s major metropoles as few companies seek offices there.

Office development activity across SA’s business hubs is at an historic high beating the highs of 1998 and 2007. Much of this activity includes Discovery Health’s new head office.

Only large corporates are taking up major office space and especially in established nodes such as Sandton in Johannesburg and Century City in Cape Town.

One major development is the Waterfall City office park. This is being developed by Attacq, a listed property developer. The office park is attracting various large corporates including PwC the auditing firm and Goldar, the engineering company.

Sapoa says that the office sector needs support in order to return to its former glory days.