Emira Property Fund sees little cheer

Emira Property Fund is forecasting a negative growth in distributions per share of about 2% when compared to expected distributions for FY16.

Emira Property Fund is forecasting a negative growth in distributions per share of about 2% when compared to expected distributions for FY16.

Emira Property Fund has warned that its results for the year 2017 could be lower than the audited results for the previous year.

In a trading statement released on Monday, the JSE-listed REIT is forecasting a negative growth in distributions per share of about 2% when compared to expected distributions for FY16.

The company said the forecast decline reflects the cumulative impact of numerous occurring factors, including higher vacancies in its office portfolio, rental reversions, financing costs and a lack of activity in the property market.

During the last 4 to 6 months the Fund has been negatively impacted by additional vacancies in its office portfolio that is anticipated to total approximately 30,000m² additional average vacancy in FY17.

The Fund was also anticipating the sale of certain underperforming properties mainly its office buildings, however, due to the generally depressed economic environment and the consequent lack of activity in the property market, these sales have not yet materialised.

Earlier this year the Fund with a market capitalization of R8.1bn, announced 8.8% distribution growth in the six months to December 2015.

The group owns 146 properties in SA valued at R13bn. It also has international exposure through its 4.9% holding in Growthpoint Australia, with its stake valued at R943m.

Signs of a tough Office Property Market

The corner for South Africa's office market still seems some way away from turning into positive territory, with vacancies in major centres continuing to run at fairly high levels. The economy needs to gain momentum in order to help a struggling office sector.

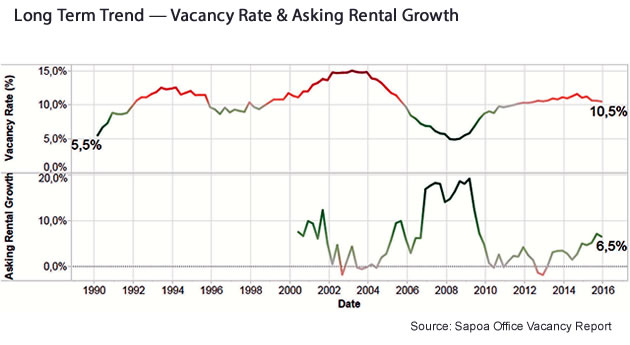

At the end of December last year, the national vacancy level was recorded at 10.5%, the South African Property Owner’s Association (Sapoa)’s latest vacancy report shows. This was flat compared with the quarter before which saw a reading of 10.6%.

The sideways trend of the last five years remains firmly in tact – ever since vacancies increased to 9.8% post the recession of 2009, Sapoa said.

Asking rentals are beating inflation, with year on year growth of 6.5% last year, which is down from 7.1% in the third quarter. Sapoa says this is because of office oversupply.