Property assets lift Arrowhead Properties' fortunes

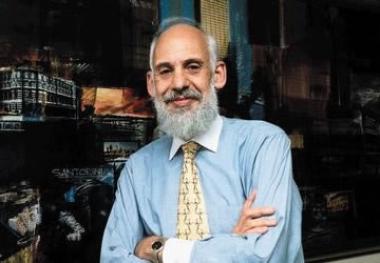

Arrowhead Properties CEO, Gerald Leissner says the quality of the assets in our portfolio increased over the past year and it is clear that the current Arrowhead is no longer the Arrowhead it was at listing with perceived secondary properties.

Arrowhead Properties CEO, Gerald Leissner says the quality of the assets in our portfolio increased over the past year and it is clear that the current Arrowhead is no longer the Arrowhead it was at listing with perceived secondary properties.

Property portfolio, with acquisition of Vividend Income Fund the biggest contributor, cited as main reason behind Arrowhead Properties distribution growth in the financial year to September.

The JSE-listed Reit on Monday declared a distribution of 36.43c per combined A and B unit for the quarter ended September 30 2014.

This is a 24.2% improvement on the 29.33c distribution over the same period in 2013. Distribution for the year to September 2014 was therefore 133.24c per combined A and B unit, a 17.9% increase over the prior year.

Arrowhead said two major factors transformed its business during the year, the acquisition of Vividend Income Fund for about R1.3bn and the company’s entrance into the residential market, with acquisition worth more than R500m.

Mark Kaplan, COO of Arrowhead commented: "We continued to improve the quality and size of our portfolio through acquisitions in line with our strategy, and capitalised on the consolidation that took place in the sector with the successful acquisition of Vividend which added retail, office and industrial properties worth approximately R2.3bn to Arrowhead’s portfolio."

The property portfolio, including shares in Dipula, increased from R3,1 billion to R7,3 billion and the market capitalization from R2,8 billion to R5,9 billion at year end.

It also grew its net property income on the core portfolio 6.9%, and 9.1% after gearing. This was ahead of average market distribution growth of 8.5% with gearing.

Vacancies decreased from 9% to 6,26% on the commercial portfolio and 1,2% on the residential portfolio.

Stanlib head of listed property Keillen Ndlovu said Arrowhead’s impressive distribution growth has been largely driven by their acquisitive strategy.

"The company has managed to consistently show that their strategy of acquiring higher yielding assets is working in their favour," he said.

Corporate Activity: Arrowhead and Dipula

Meanwhile Arrowhead’s intended takeover of substantially black-owned and managed Dipula Income Fund could turn hostile.

Dipula CEO Izak Petersen on Wednesday spoke out strongly against Arrowhead’s overtures after the release of Dipula’s annual results.

Arrowhead acquired 22% of Dipula’s B units in March and recently increased its stake to 25%. Arrowhead has been one of the sector’s most aggressive players on the corporate action front, earlier this year completing a takeover of Vividend.

Mr Petersen said he did not believe a merger would be in the best interest of shareholders.

"Dipula and Arrowhead are not a good fit. Our strategies and portfolios are very different. It appears Arrowhead wants to grow assets at any cost. That’s not our game. We are very discerning in our acquisitions.’’

The JSE’s R350bn property sector has been on a continuing consolidation drive over the past 18 months, with a number of smaller and mid-sized funds becoming takeover targets.

Successful deals to date include Redefine Properties’ buyout of Annuity Properties and mergers between sister companies Acucap and Sycom Property Fund, and Octodec Investments and Premium Properties.