Offshore exposure boosts Capital Property Fund performance

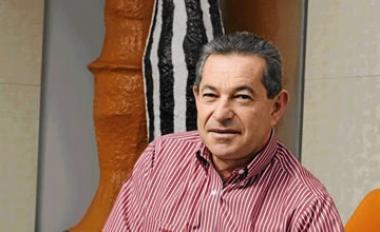

Capital Property Fund MD, Barry Stuhler says he would like to further increase the fund’s offshore exposure to around 30% of total assets.

Capital Property Fund MD, Barry Stuhler says he would like to further increase the fund’s offshore exposure to around 30% of total assets.

Capital Property Fund’s strategy to increase its exposure to rand hedge sister companies New Europe Property Investments (Nepi) and Rockcastle Global Real Estate Company continues to pay off.

The fund delivered a better than expected 10.23% increase in income payouts for the six months ending June‚ comfortably exceeding the 9% forecast and the 7%-8% market average. It is the first time in three years that Capital has achieved double digit distribution growth.

Capital has underperformed the sector slightly in terms of share price growth over the past year‚ no doubt due to lingering concern around its exposure to the struggling office market.

But analysts believe that Capital’s management team is making impressive headway to offload underperforming offices. Says Stanlib head of listed property funds Keillen Ndlovu: “We are currently overweight on Capital. The stock offers good value and we are seeing the share price starting to come back.’’

Capital is the largest owner of A-grade warehouse and distribution space in SA and the sixth largest property stock on the JSE with a market capitalisation of R17.2bn. The fund has over the past two years steadily increased its exposure to offshore real estate through Romanian-focused Nepi and Rockcastle‚ whose earnings are denominated in euro and US dollar respectively. Capital’s offshore interests have increased from 4.5% of total assets in December 2012 to 19% in June.

Capital CEO Barry Stuhler says he would like to further increase the fund’s offshore exposure to around 30% of total assets. “We are constantly looking for other avenues for offshore growth but currently we believe Nepi and Rockcastle still offer the best value.”

Apart from the rand weakness benefit that flowed from the Nepi and Rockcastle investments‚ Capital’s improved distribution growth performance was driven by the sale of non-core buildings and lower vacancies‚ which decreased from 5.1% in December to 4.2% in June.

Mr Stuhler said tenant retentions were also better than anticipated‚ which results in lower costs of occupation. “It is far more expensive to sign up new tenants than to retain existing ones as new tenant installations and letting commissions pushes up a landlord’s costs.”