Delta International makes JSE debut

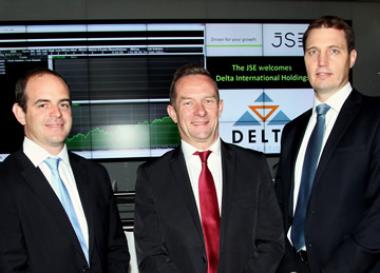

Seen at the Delta International Property Holdings JSE listing event: Greg Pearson, COO; Louis Schnetler, Incoming CEO and Greg Booyens as CFO.

Seen at the Delta International Property Holdings JSE listing event: Greg Pearson, COO; Louis Schnetler, Incoming CEO and Greg Booyens as CFO.

Delta International Property Holdings which has a primary listing on the Bermuda Stock Exchange, today listed on the Johannesburg Stock Exchange (JSE) raising about R915m (US$87m) to fund its growth plans in Africa.

Delta International formerly OSIRIS Properties International, becomes the first outright africa property fund to list on the JSE.

The listing aims lure South African investors access to a dollar hedged investment without having to use their exchange control allowance.

Other Rand hedge stocks such as Capital & Counties Properties, Redefine International, MAS Real Estate, New Europe Property Investments and Intu Properties remain attractively valued compared to pure domestic businesses.

Delta listed a total of 43-million shares on the JSE AltX last week at an issue price of US$2 per share, raising about R915m (US$87m) by way of private placement.

“We are very excited about Delta International’s prospects on the continent. The JSE listing provides a solid platform for growth,” commented CEO designate, Louis Schnetler, who will take up the reins on 1 August 2014.

Its portfolio is located in high-growth nodes in Casablanca, Morocco and in Maputo, Mozambique which includes shopping mall and office complexes, tenanted by blue chip multinationals such as H&M, Marks & Spencer, Virgin Mega Store, British Petroleum, KPMG and Hollard Insurance.

Delta International’s first phase of geographic expansion targets Morocco, Mozambique, Ghana and Nigeria. The second phase of expansion over the medium to longer term includes Angola, Gabon, Tanzania, Tunisia, Zambia and Zimbabwe.

“Our geographic spread will be across north and sub-Sahara Africa, excluding South Africa. We have identified an acquisition pipeline of up to US$250 000 000,” commented Sandile Nomvete, Chairman of Delta International.

“Core to the portfolio will be office and dominant retail assets, but we will also consider strategically placed hotels, distribution centres and some residential acquisitions provided these are in rapidly urbanising areas and are underpinned by a sovereign lease,” he added.

The Company does not assume any development or tenant risk and will generally only acquire assets with secured income streams.

“Before entering a country, we carefully analyse political and economic stability, expected GDP growth as well as the ease of doing business, especially the applicable tax regime and repatriation of dividends,” Nomvete explains.

“Assets are considered for acquisition based on tenant quality, tenure and sustainability. The node in which the asset is located also plays an important role, as we only invest in high-growth nodes where we can achieve an appropriate yield,” he concludes.

Following the private placement, Delta International is 25% held by JSE-listed Delta Property Fund Limited.