Arrowhead Properties interim distribution rises

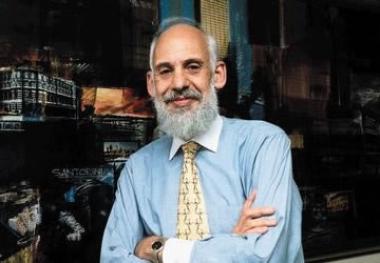

Arrowhead Properties CEO, Gerald Leissner said the company worked hard during the period growing our asset base, acquiring five commercial, industrial, retail properties for R535 million and residential properties for R150m.

Arrowhead Properties CEO, Gerald Leissner said the company worked hard during the period growing our asset base, acquiring five commercial, industrial, retail properties for R535 million and residential properties for R150m.

Arrowhead Properties Limited, today reported total distribution to unit holders of 32,38 cents per combined A and B unit for the quarter ended 31 March 2014, which translate to 15,48% improvement comparable period a year earlier.

The distribution for the six months to 31 March 2014 is therefore 62,58 cents per combined A and B unit, growth of 13,49 cents over the same period for 2013.

The core portfolio as at 31 March 2014, showed growth of 6,94% before gearing. The asset base as at 30 September 2013 grew by R1,5 billion to R4,6 billion and the market capitalisation increased from R2,8 billion to R4,4 billion.

Commenting on the results, Gerald Leissner CEO of Arrowhead said the company worked hard during the past six months growing our asset base, acquiring five commercial, industrial, retail properties for R535 million and residential properties for R150 million, all at yields that are revenue enhancing.

The Property loan stock company disposed of the Education Building in King Wiliams’ Town for R2,8 million.

Arrowhead also acquired, by the issue of Arrowhead units, 22% of the B units in Dipula Income Fund as well as 32% of the units in Vividend Income Fund and the Vividend Management Company for R88,6 million. The company is to make an offer to acquire all the issued linked units in Vividend through schemes of arrangement.

The fund’s net borrowings of R873 million as at 31 March 2014 (1H13: R575 million) translates to a gearing ratio of 23% versus 21% for the comparable period.

“Our treasury places excess funds in our access facility to reduce the overall interest charge. The effective interest rate for the period is 8,28% and interest rates on more than 90% of our debt has been fixed for five years at rates of between 9,37% and 9,58%,” says Imraan Suleman, CFO of Arrowhead.

Arrowhead concluded an accelerated book-build on 23 January 2014 which was oversubscribed at a discount of just over 3% to the closing price on the day prior to the book-build. The amount raised was increased from R400 million to R490 million as a result of the high demand.

“The result of the capital raising demonstrates the confidence that the investment market has in the Arrowhead strategy and management. We are, therefore, pleased that Gerald Leissner’s contract has been extended to 31 March 2017 and similarly that of Mark Kaplan and Imraan Suleman to 31 March 2019,” says non-executive Chairman Taffy Adler.

Revenue, including rental income and expenditure recoverable from tenants, increased by 39,5% to R270,5 million, boosted by the full effect of the acquisitions concluded during the previous financial year, the partial impact of the assets acquired in the current period as well as the annual escalations of existing leases.

The group's property portfolio consists of 48% commercial, 35% retail, 14% industrial and 3% residential properties across all nine provinces within South Africa. The occupancy rate of the portfolio as at 31 March 2014 is 92%.

Property expenses increased in line with the enlarged portfolio, however, the ratio of gross property expenses has remained constant at 33,3%. Recovery of municipal expenses has improved to 91% (1H13: 87%) due to increased efficiencies in the recovery process.

“We will continue to grow Arrowhead in line with our strategy. Taking into account the acquisitions concluded to date and the performance of the existing portfolio, we expect to achieve a distribution growth per combined A and B linked unit for the year ended 30 September 2014 of 16,8% on the distribution to 30 September 2013,” concluded Leissner.