Capital Property Fund eyes in-house asset management operations

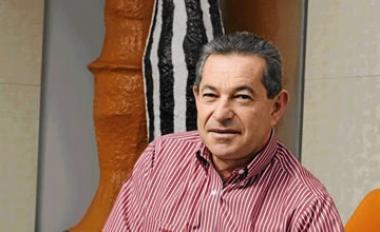

Last year, Capital Property Fund Managing director, Barry Stuhler said it was best international practice to have the asset- management companies internalised — it takes away any form of conflict.

Last year, Capital Property Fund Managing director, Barry Stuhler said it was best international practice to have the asset- management companies internalised — it takes away any form of conflict.

JSE-listed property group, Capital Property Fund (CPL) on Friday fleshed out restructuring plans that aim to position it as a corporate real estate investment trust.

The proposals will internalise the management of the company in a manner that would better align the interests of management with those of investors‚ the property fund said in a statement.

“The board believes that Capital is now at a stage where it is preferable to internalise its asset-management function. The internal management model is considered consistent with investor preferences and best practice globally regarding management and governance for the sector‚” it said.

Internalising management is often thought to remove any conflict of interest between management and investors.

As the fees of external management companies are determined, in part, by the size of the portfolios they manage, this could lead to a potential conflict of interest given the incentive to grow the asset base, possibly at the expense of yield.

In terms of the proposals‚ Capital unitholders will become direct shareholders in New Capital‚ which will be separately listed on JSE on June 30.

Capital Property Fund is part of the Resilient family firms, which hold stakes in each other, include Resilient Property Income Fund, Fortress Income Fund, New Europe Property Investments and Rockcastle Global Real Estate Company.

Capital has a market cap of about R20bn and is the dominant player in the SA industrial property sector. The fund's direct property assets are mainly in Gauteng and KwaZulu Natal.

Capital owns a portfolio of 262 retail, office, industrial and other properties.

Capital's strategy remains the investment in and development of A-grade distribution and warehousing facilities in strong nodes.