Safari Investments to list on JSE following private placement

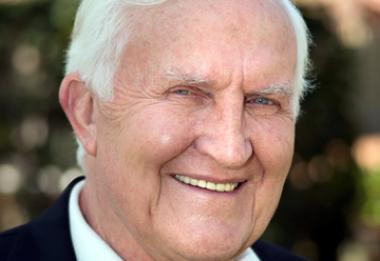

Safari Investments CEO Francois Marais says listing on JSE will provide potential investors with an opportunity to gain access to a unique high quality and high growth portfolio of assets which is both defensive and has significant growth potential.

Safari Investments CEO Francois Marais says listing on JSE will provide potential investors with an opportunity to gain access to a unique high quality and high growth portfolio of assets which is both defensive and has significant growth potential.

Safari Investments which was incorporated in 2000 and has established a sought after retail portfolio, intends to make its debut listing on the Johannesburg Stock Exchange (JSE) main board as a Retail REIT next month.

The listing will be preceded by a capital raising by way of private placement of approximately R300 million to R400 million.

The net proceeds of the offer will be used to settle all debt and free up existing facilities of approximately R600 million that will support the company’s project pipeline.

Focused on high growth township areas, Safari’s property portfolio comprises four well-established and strategically located retail properties independently valued at approximately R1.3 billion with a total Gross Lettable Area (“GLA”) of some 125,000 m².

The property portfolio is 100% retail based and focused on high quality retail centres in affluent townships across Gauteng, including prominent nodes in Mamelodi, Atteridgeville and Sebokeng where Safari has spent some R40 million on revamps over the past two years.

The fourth centre is located in Heidelberg and is the latest addition to the portfolio. Internationally, Safari is in the process of developing a new regional destination centre in the Namibian town of Swakopmund.

Based on demand and commitments from national tenants, Safari is currently adding some 45 000 m² of retail space by way of further developments in Atteridgeville and Sebokeng and the greenfield development in Namibia.

Safari CEO Francois Marais commented: “This listing provides potential investors with an opportunity to gain access to a unique high quality and high growth portfolio of assets which is both defensive and has significant growth potential due to our unique community retail focus. Based on the existing redevelopment and development pipeline, we anticipate our portfolio to double in the next 3 to 4 years.

“We believe that the entrepreneurial approach to all our developments and historical focus on township developments will continue to deliver stable, resilient cash flows supported by significant income generation and low risk growth upside that will deliver attractive returns for shareholders.”

Safari’s portfolio was funded and developed by approximately 150 shareholders with a wide range of skills including architects, engineers, property developers, accountants and medical doctors.

In early 2013, a strategic decision was taken by the shareholders of Safari to diversify its sources of funding and take advantage of the favourable legal and tax framework provided to qualifying property entities in terms of the REIT legislation.

Safari’s listing is subject to the JSE’s approval of the listing documentation and subsequent listing. A Pre-Listing Statement (“PLS”) is to be published in due course providing full details of the offer of ordinary shares.

The Company has appointed DEA-RU Proprietary Limited as lead advisor and bookrunner of the proposed offer of ordinary shares and PSG Capital as the sponsor to the Company.