Visual International Holdings to list on JSE’s AltX

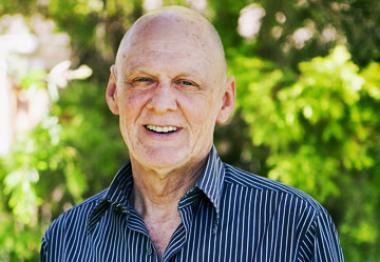

Charles Robertson, Visual International founder says demand for quality housing from the growing middle-income market in South Africa is strong. Our model of developing mixed-use suburbs on suitable land near jobs and infrastructure,

Charles Robertson, Visual International founder says demand for quality housing from the growing middle-income market in South Africa is strong. Our model of developing mixed-use suburbs on suitable land near jobs and infrastructure,

Visual International Holdings which develops mixed-use residential suburbs for the middle-income market, intends to raise R33 million prior to listing on the JSE’s AltX next month, through the issue of its shares.

With a decade-long track record, the company had grown its assets to around R126,5 million. Its net asset value is around R60 million, and spans some 80,000sqm of developable bulk that is ultimately expected to produce real estate investment of around R2 billion.

The AltX, or alternative exchange, is a division of the JSE and a parallel market focused on good quality small-and medium-sized high-growth companies. It provides these companies with a clear growth path and access to capital, while giving investors fresh, exciting opportunities and the prospect of investing in a growing business.

Established in 1993, Visual International intends to raise R33 million prior to listing on the AltX, through the issue of 66,000,000 new shares at R0.50 per share. This will unlock the next chapter of its growth path, with the capital raised applied to fast-tracking its residential development plans at its flagship Stellendale Village over the next two years.

Stellendale Village development is a 22 hectare mixed-use residential suburb just off the Stellenbosch Arterial in Kuils River, Cape Town.

The upshot of all this is a two-year long-term earnings per share growth forecast of 33,5% for Visual International. Being a long-term play focused on capital growth, the property development company plans to reinvest all profits for its first five years after listing without paying dividends. It will introduce dividends thereafter. “We’ve set our sights on a JSE main board listing at the right time,” says Charles Robertson, Visual International founder and managing director.

“Demand for quality housing from the growing middle-income market in South Africa is strong. Our model of developing mixed-use suburbs on suitable land near jobs and infrastructure, meets this demand,” explains Robertson.

The new shares to be issued in Visual International’s capital raising equate to 26% of the shares in the company, with 74% held by its executive team and a Kuils River empowerment initiative they have established. This aligns management interests strongly with those of investors.

Visual International is led by a experienced executive team with more than 70 years of combined experience in all aspects of the property development sector. Robertson is a property developer with 30 years experience, including projects like N1 City. Projects Director Peter Grobbelaar has extensive experience in both the construction and property development industries, including the V&A Waterfront Marina Residential Development and High Cape. Financial Director Grant Noble has extensive experience in financial management and administration of private security estates.

Their outlook for residential property for the middle market is undoubtedly positive. “We’re seeing renewed interest in residential property in South Africa and potential for good strong capital growth. Many residential developers fell victim to the effects of the global economic crisis and there have been few new builds in recent years and many abandoned projects.

Visual International has secured a pipeline of future developments and is establishing strategic development partnerships in Gauteng.