Arrowhead Properties surpasses all expectations

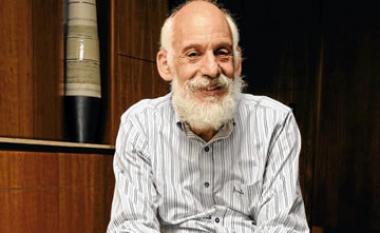

Arrowhead Properties CEO Gerald Leissner said our primary focus is growing income for our unitholders. This growth has been achieved by sweating the existing portfolio, containing costs to a level lower than rental growth and derivin

Arrowhead Properties CEO Gerald Leissner said our primary focus is growing income for our unitholders. This growth has been achieved by sweating the existing portfolio, containing costs to a level lower than rental growth and derivin

JSE-listed group Arrowhead Properties (AWA) recorded a distribution of 113.01c per combined A and B linked unit which represented growth of 12.36% for the year to September.

This was more than the 7% average growth achieved in the sector and the fund’s forecast 10% distribution growth for the year.

The year ended September 2013 marks Arrowhead’s second year as a listed entity and the last as a property loan stock company. Arrowhead converted to a real estate investment trust (Reit) on October 1 2013.

The asset base grew by R723 million to R3,1 billion.

The distribution for the fourth quarter of the financial year was 29.33c and the company expected the next distribution to exceed the 30c threshold at which the A units start to participate in the growth in distributions‚ it said.

Arrowhead CEO Gerald Leissner said our primary focus is growing income for our unitholders. "This growth has been achieved by sweating the existing portfolio, containing costs to a level lower than rental growth and deriving income from acquisitions,” he said.

Occupancy levels are currently at 91%, an increase from 87% on the comparable period.

Imraan Suleman, CFO of Arrowhead commented; “The majority of the vacancies are in the commercial sector where the letting of office space has proved challenging – but this was not unexpected. Whilst there has been a noticeable increase in enquiries for vacant office space, we anticipate only seeing the take up once the economy starts to improve.”

Arrowhead owns a diverse portfolio of retail, commercial and industrial properties in secondary locations throughout South Africa. To further diversify their offering, Arrowhead recently concluded the acquisition of a portfolio of residential properties servicing the affordable housing market to the value of R406 million.

Commenting on the newly acquired residential portfolio, Mark Kaplan COO of Arrowhead added, “We are excited about this direction that the Fund is taking as have identified the residential market as an opportunity which could offer significant growth and a competitive advantage in a tough market.”

Alternative Real Estate property fund manager Maurice Shapiro said: “In more developed countries‚ residential properties represent between 10% and 15% of the listed property sector. In South Africa this is less than 1%. Management’s innovative approach in including residential property in the portfolio and the recent South African Reit tax legislation paves the way for the South African listed property sector to have an exclusive residential offering.”