GoGlobal to list on JSE’s AltX

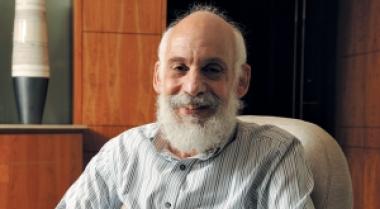

Gerald Leissner, Chief Executive Officer of Arrowhead Properties has been appointed CEO of GoGlobal Properties‚ which was incorporated in Bermuda in October last year.

Gerald Leissner, Chief Executive Officer of Arrowhead Properties has been appointed CEO of GoGlobal Properties‚ which was incorporated in Bermuda in October last year.

GoGlobal Properties has invited investors to subscribe for up to 250‚000 of its shares as part of its intended listing on the JSE’s AltX on April 29.

The company which listed on the Bermuda Stock Exchange last month‚ expected its primary listing in Bermuda to provide access to “a global investor base of managed funds‚ high net worth individuals and other sources of capital”.

The secondary listing on the AltX would enhance GoGlobal’s ability to raise capital.

“Against the backdrop of fragile economic conditions in the UK‚ the availability of capital in the UK remains constrained. Accordingly‚ the promoters are looking to establish a vehicle that can access the South African capital base‚” the company said.

Arrowhead Properties CEO Gerald Leissner has been appointed CEO of the company‚ which was incorporated in Bermuda in October last year.

GoGlobal said it had offered invited investors only to subscribe for up to 250‚000 of its shares.

The company would initially seek to acquire small stakes in large UK and European real estate investment trusts (Reits) “and may look in time to acquire controlling interests in selected small listed UK Reits”‚ it said.

GoGlobal would also actively pursue attractive opportunities to invest in direct property assets‚ with a focus on investing in high-yielding commercial properties throughout the UK and other European countries.

It would not have a particular sector focus‚ but expected the bulk of investments to be in the retail‚ office and industrial warehousing and distribution sectors.

GoGlobal announced Pauline Goetsch as its financial director. Ms Goetsch and Mr Leissner were involved in establishing ApexHi Property Fund‚ a UK Reit which listed on the Channel Islands Stock Exchange in 2011. This Reit is a separate entity to ApexHi Properties‚ which was previously listed on the JSE.

Other property groups with secondary listings on the JSE include New Europe Property Investments (Nepi)‚ which has property interests in Romania.

Osiris Properties‚ which also has its primary listing in Bermuda and focuses on UK and European property‚ listed on the JSE’s AltX in August last year.

Evan Robins‚ senior portfolio manager in MacroSolutions at Old Mutual Investment Group‚ said offshore property was more attractive than South African property to many local investors‚ and offered investors “diversification and hard currency exposure”.

A listing on the JSE by foreign property groups allowed institutional and individual investors from SA a way to invest “without having to worry about exchange control allowances”.

With South African investors and fund managers having relatively limited access to international property groups‚ offshore property investments were often worth more to the local market than to other markets.

Mr Robins said companies choosing to have a secondary listing on the JSE were “arbitraging cost of capital differences” while allowing local investors offshore exposure.