Arrowhead to acquire properties from Growthpoint for R167,6m

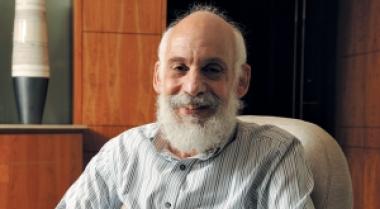

Gerald Leissner: Chief Executive Officer at Arrowhead Properties.

Gerald Leissner: Chief Executive Officer at Arrowhead Properties.

Arrowhead Properties, listed on the JSE in November, is to acquire a portfolio of office buildings from Growthpoint Properties for R167,6m based on a yield of 11%.

Arrowhead Properties, which debuted on the JSE in November, is to acquire a portfolio of office buildings from Growthpoint Properties for R167,6m based on a yield of 11%.

Chief operating officer Mark Kaplan said the acquisition emphasised Arrowhead’s strategy of identifying yield-enhancing opportunities and increasing the size of the portfolio in order to reduce the risk associated with any one property.

The company said on Friday that the portfolio consisted of eight small office buildings, measuring in total 17000m², in decentralised nodes in Johannesburg, Pretoria, Durban, Cape Town and Alberton.

“Arrowhead is focused on growing income per unit,” Mr Kaplan said.

Arrowhead was listed with a market capitalisation of R800m after Redefine Properties unbundled properties it did not want into the new fund.

The company had bought 96 properties valued at R1,7bn from SA’s second-largest property group, Redefine Properties, and had borrowed R800m from Standard Bank. Its plan is to grow its portfolio to R10bn within the next five years.

The fund is replicating the old ApexHi model, a high-yielding portfolio of older buildings in secondary areas.

Arrowhead now owns an unbundled portfolio of Redefine buildings, 98 smaller grade B and C retail, office, industrial and mixed-use properties.

Most of the buildings are valued at less than R30m and are no longer core to Redefine. The portfolio has a wide spread across SA, from King William’s Town in the Eastern Cape to Klerksdorp in North West.

The tenant profile consists of large listed and national tenants, the government and franchisees, including Absa, Edcon, Mr Price, Shoprite, Capitec, Ellerines and Famous Brands.

Some analysts regarded the unbundling of Arrowhead from Redefine as a partial reversal of the Redefine-ApexHi merger.

The initial attraction of ApexHi, and subsequently Redefine, was the high yield and growing income stream. But the unbundling represented another opportunity for investors to access high-yielding instruments within the listed property market, which may not be a bad thing given global volatility.

Arrowhead is managed by the experienced Gerald Leissner, the former CEO of ApexHi.

Mr Leissner is expected to unlock value from the portfolio given the success he achieved at ApexHi.