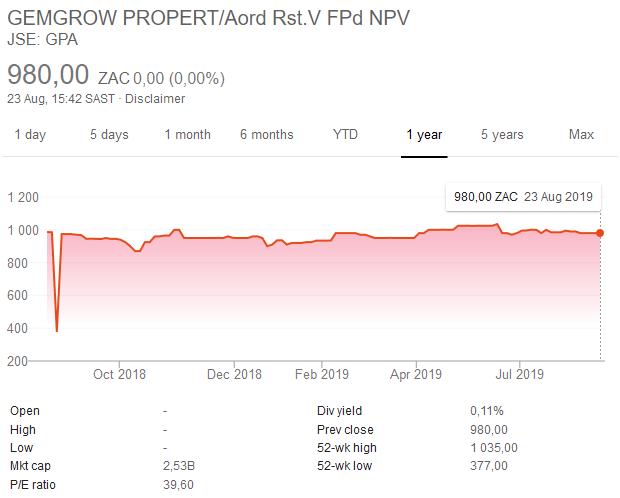

Gemgrow, Arrowhead shareholders approve R16 billion merger

Shareholders of Gemgrow Properties and Arrowhead Properties have approved the R16 billion merger of the two JSE-listed real estate investment trusts (Reits).

Consolidation is taking hold in the listed property sector, with Delta Property Fund and Rebosis Property Fund set to merge. Safari Investments moving towards a deal with Comprop, which is part of the Futuregrowth Asset Management stable.

But SA Corporate Real Estate said recently it was not interested in any of the offers it had received from the Dipula Income Fund and Emira Property Fund saying they were not in the best interests of the company.

Launching an R16 billion property company including listed investments, the reverse takeover of Gemgrow by Arrowhead, which previously held 53.3% of Gemgrow’s shares, will create a larger property portfolio of 212 properties, diversified across the three primary asset classes spread across all nine provinces in South Africa.

The larger group will be listed under Arrowhead Properties Limited name, with JSE ticker code AHA and AHB for the A shares and B shares respectively. Investors will be able to trade the new entity’s shares from Monday, 16 September 2019.

“The current environment for 100%-South African property funds remains difficult, but the team is focused on matters it can influence including the letting of vacant space, the renewal of leases and collection of rentals. Whilst one is cognisant of both the global and local challenges, we remain positive and will continue to strengthen the operational requirements of the business thereby controlling what is in our hands. As a larger, stronger entity we are well-positioned to weather the current uncertain conditions and beyond,” says Arrowhead CEO Mark Kaplan.

Other advantages of the merger are that it creates a simpler, more efficient structure that improves liquidity for Gemgrow shareholders and will position the Company better to access equity markets to pursue growth opportunities should equity markets improve in the future. The new Arrowhead retains the Gemgrow dual-class share structure, which, although there is no current intention to issue additional A shares, is a valuable differentiator in the REIT sector.

“Management’s focus, post-merger, will be to strengthen the Company’s balance sheet and deliver long-term shareholder value and sustainable earnings,” Kaplan says.

Leading up to the transaction, Gemgrow progressed well in strengthening its balance sheet by selling off a number of non-core assets with non-sustainable income. To date, it has disposed of over R800 million of assets, of which R350 million has already been transferred. The proceeds will be applied to reducing debt.

The merged entity is well diversified across South Africa with 41% of its income in Gauteng; 10% in KwaZulu Natal; 13% in the Western Cape and 16% in Limpopo respectively. It is well balanced across different asset classes, with 46% of income in retail, 36% in office and 18% in the industrial space.

The new Arrowhead will be headed by Mark Kaplan as Chief Executive Officer, Junaid Limalia as Chief Financial Officer, Riaz Kader as Chief Operating Officer and Alon Kirkel as Chief Investment Officer.